Simplify Your Financial Needs:

Combine gamified AI tools with expert human guidance to plan, visualise, and manage every part of your financial life—from debt management to portfolio optimisation.

Join 92% of clients building healthier financial habits.

Gain Control of Your Finances

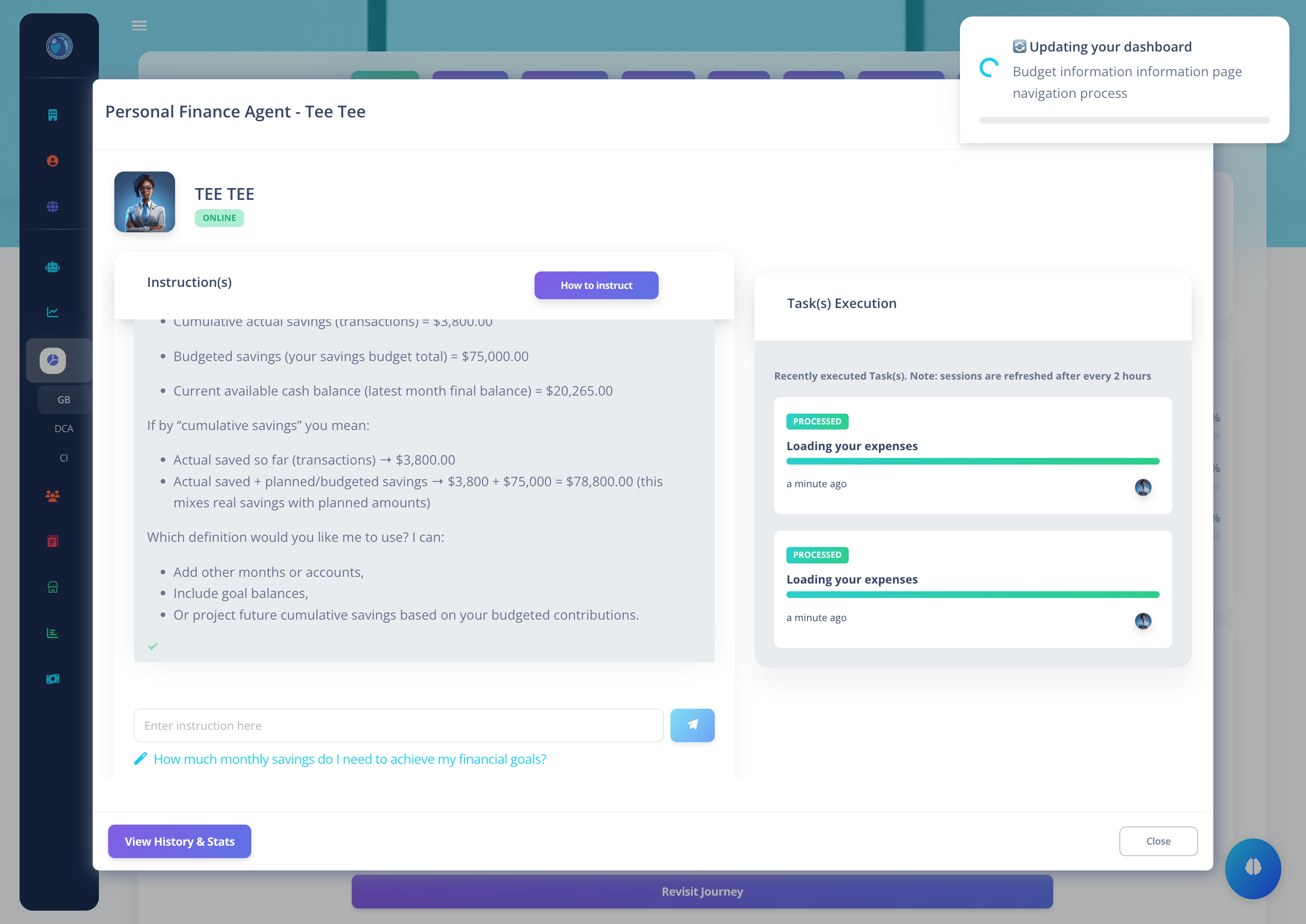

Integrate AI into your financial workflow

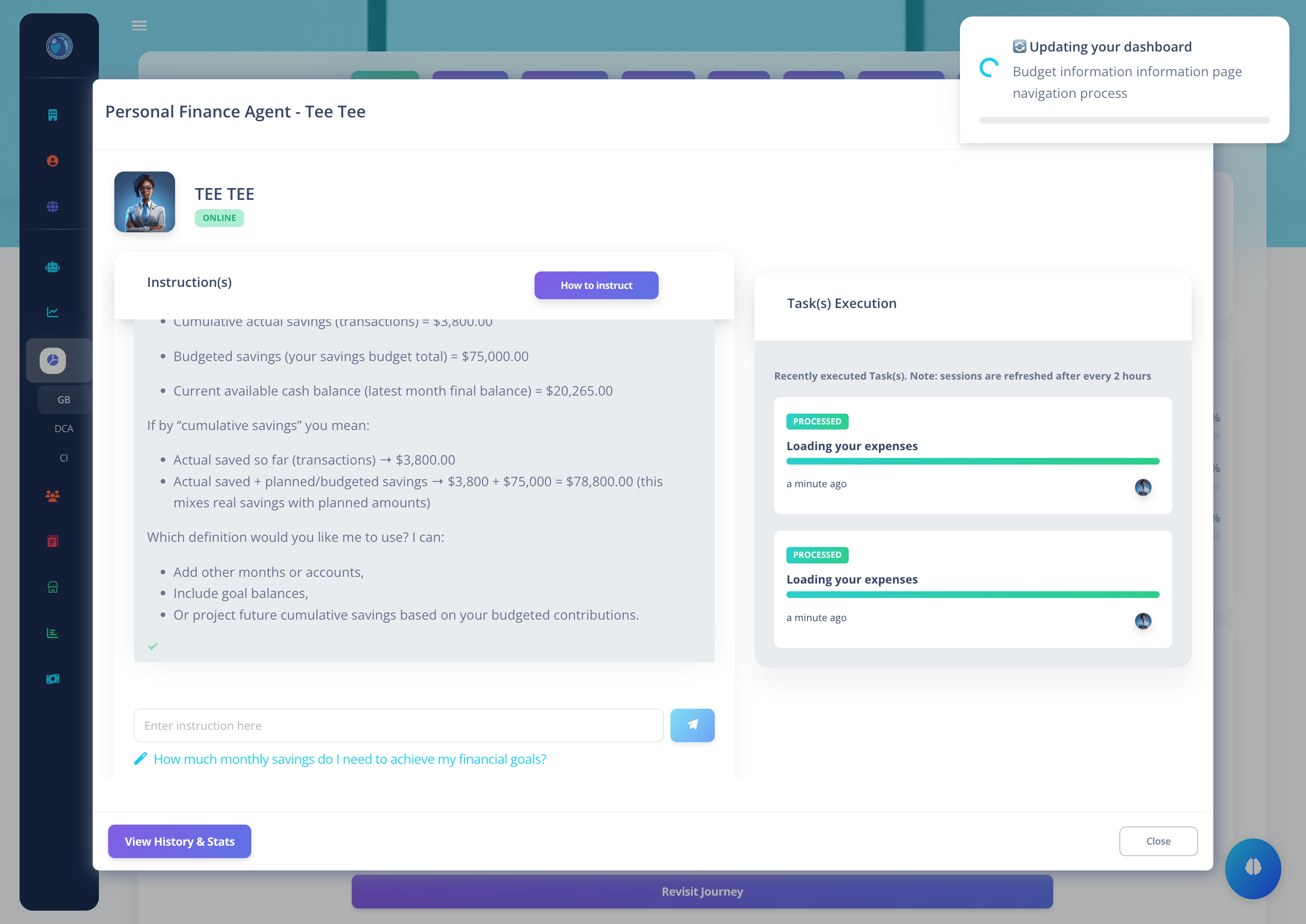

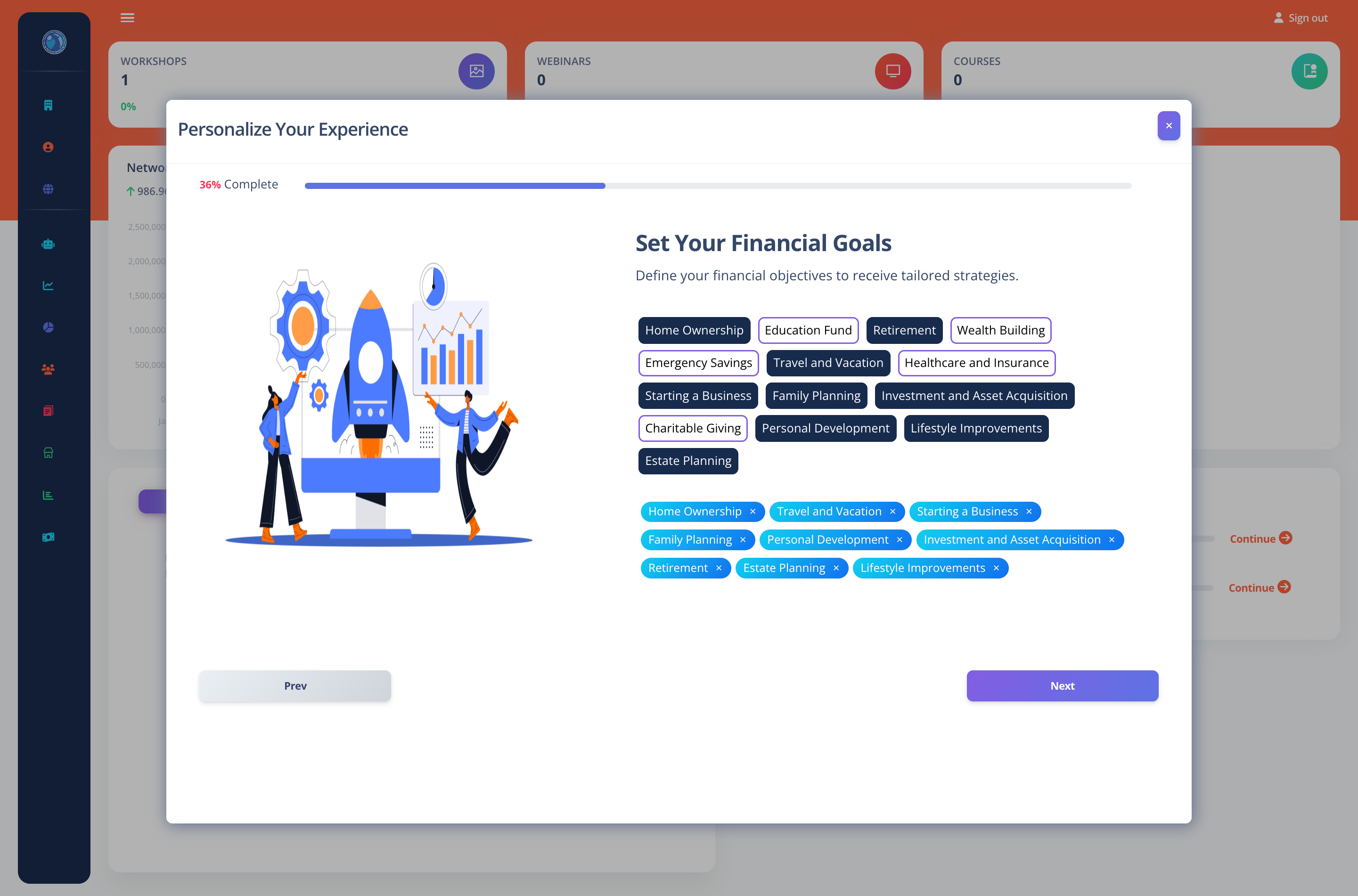

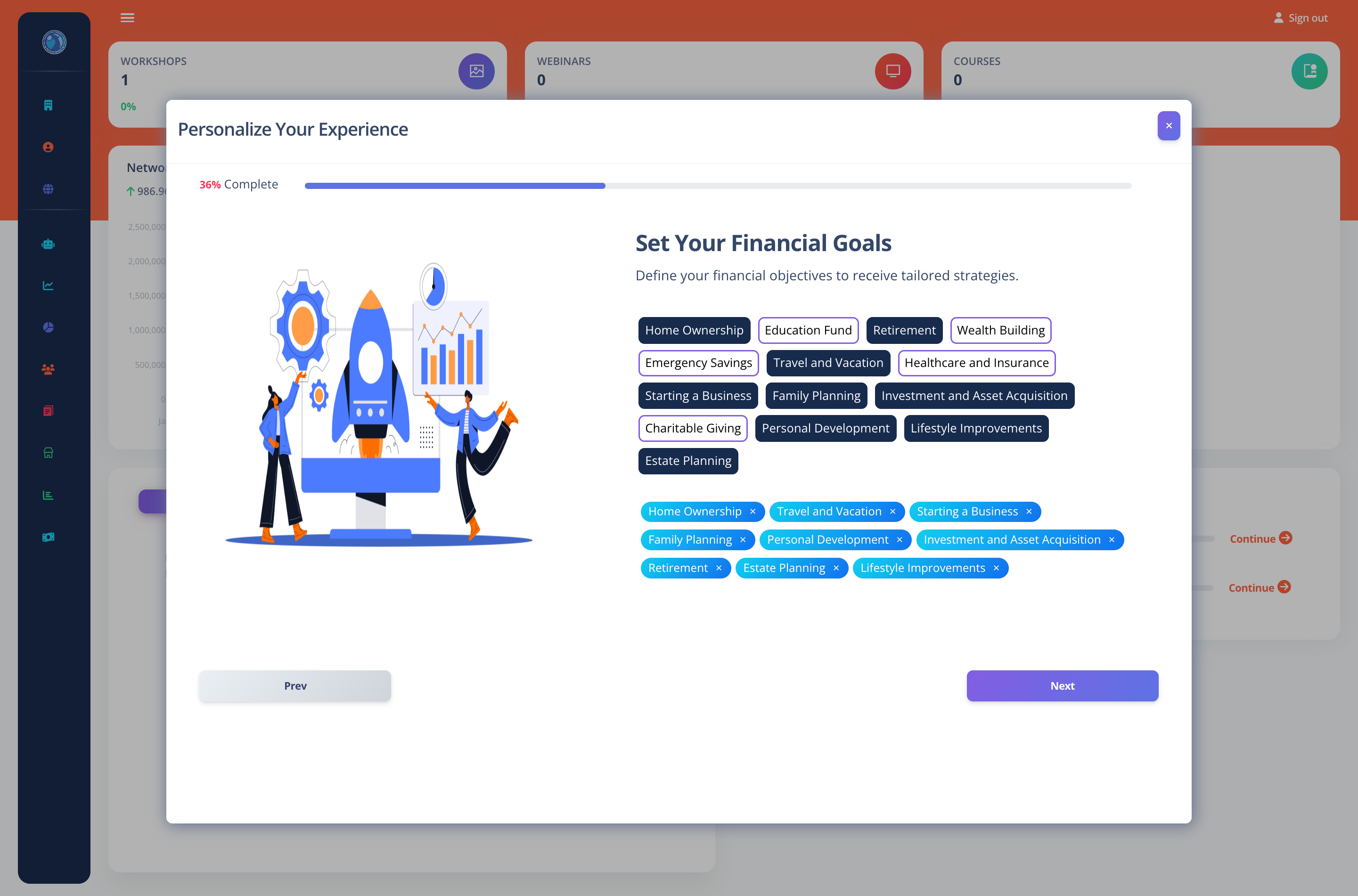

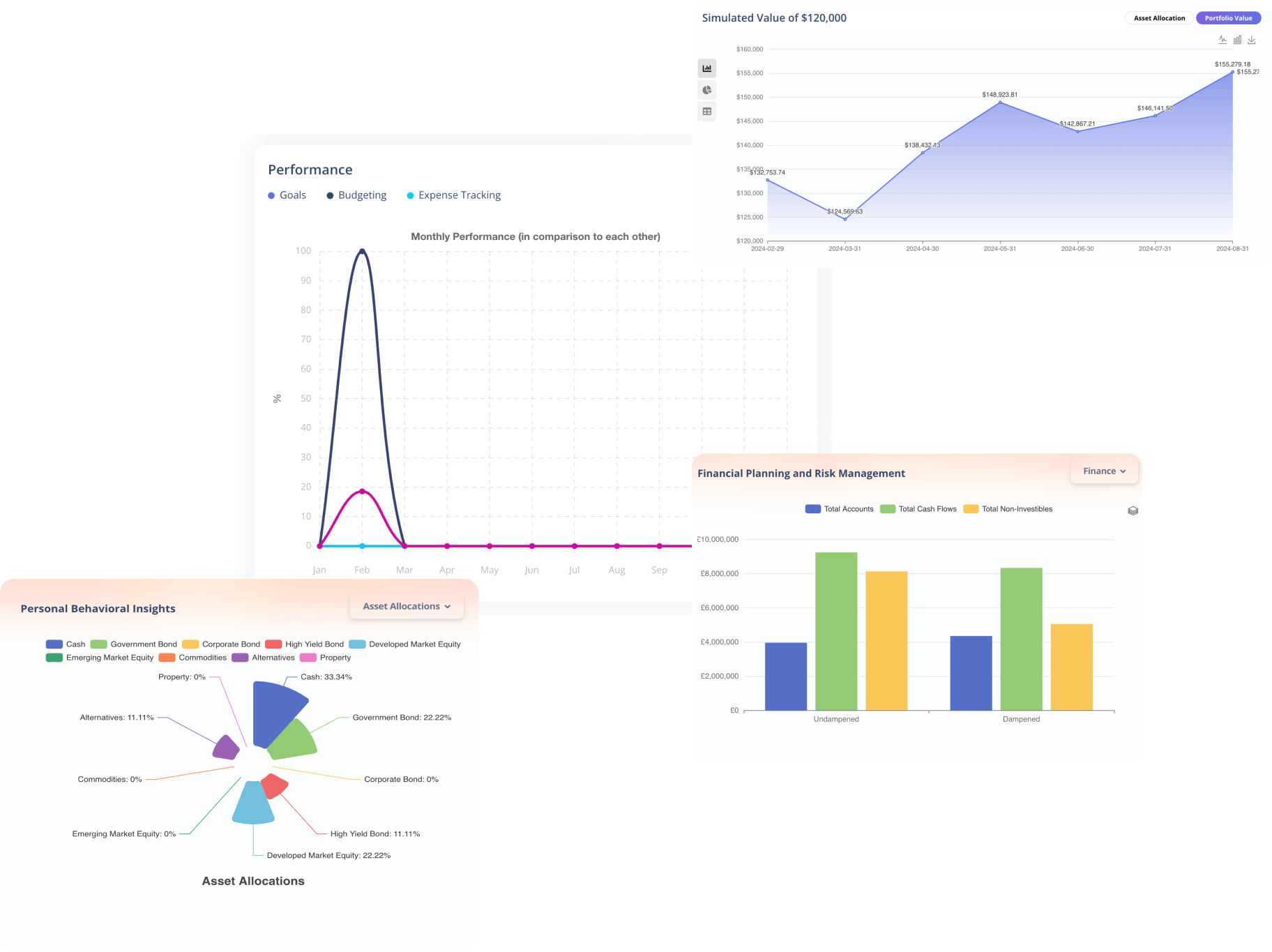

Personalised Financial Planning

Develop a tailored life profile, set clear goals, and receive intelligent guidance with AI-driven tools for effective Asset Allocation, Financial Advisory, and Coaching.

Learn more →

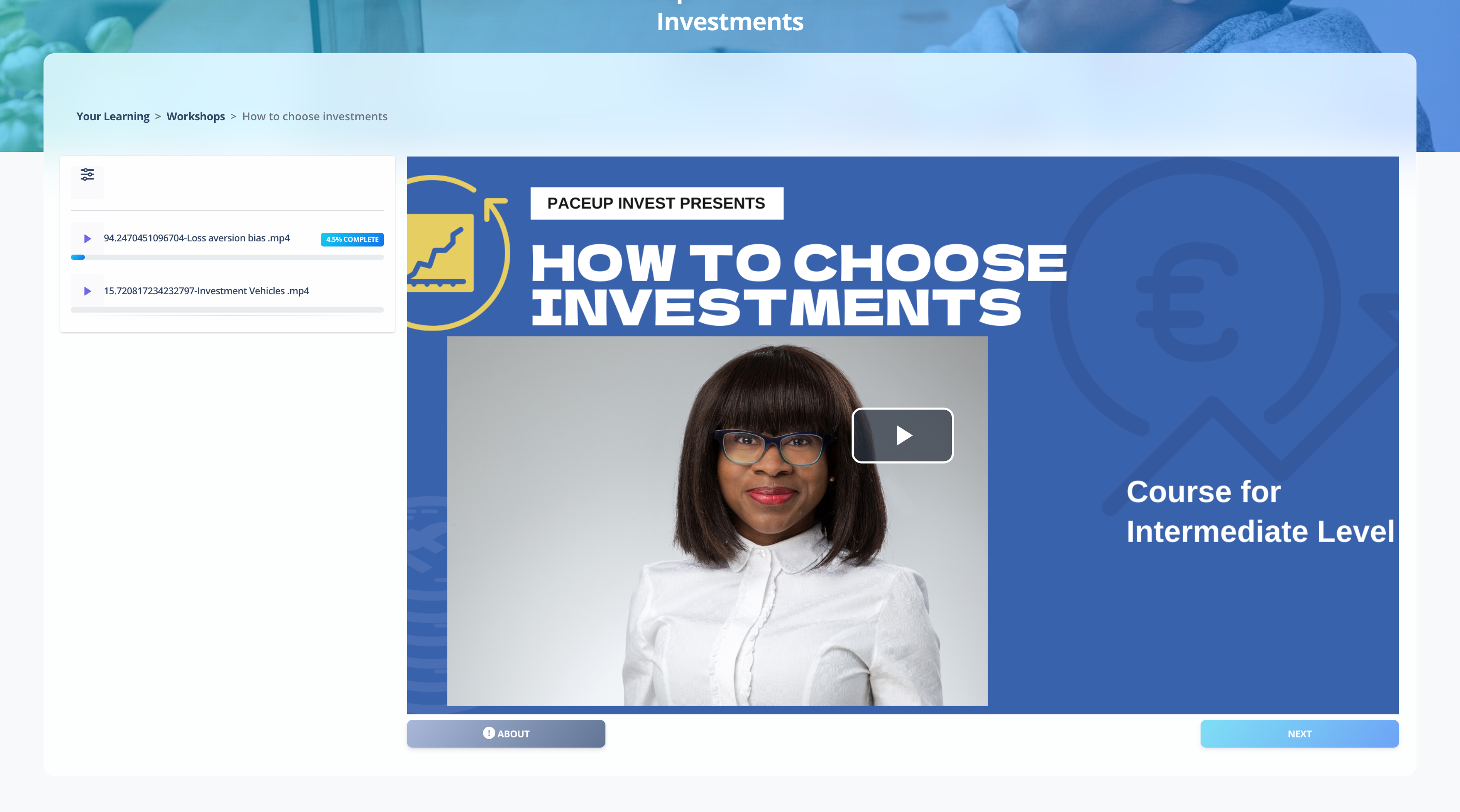

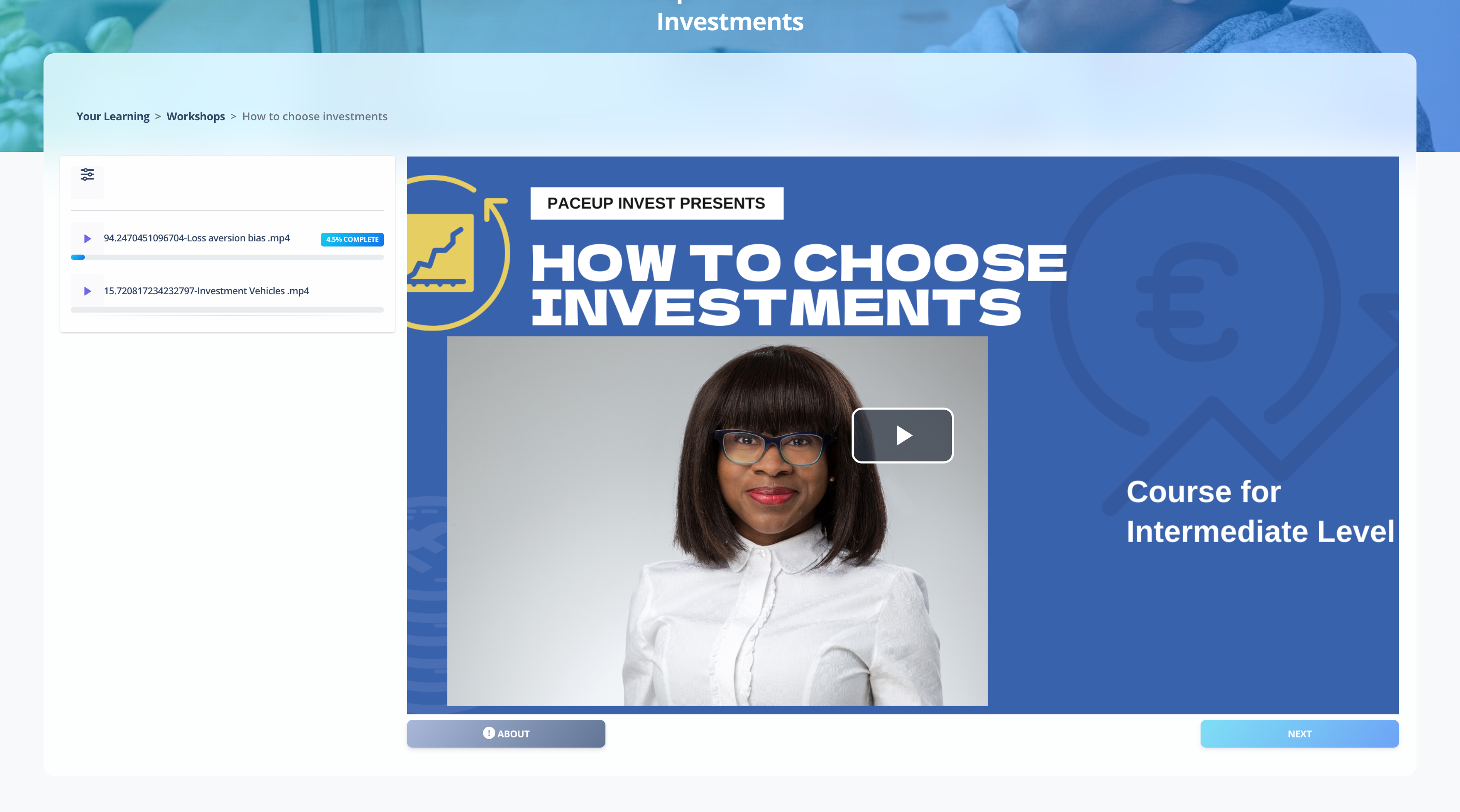

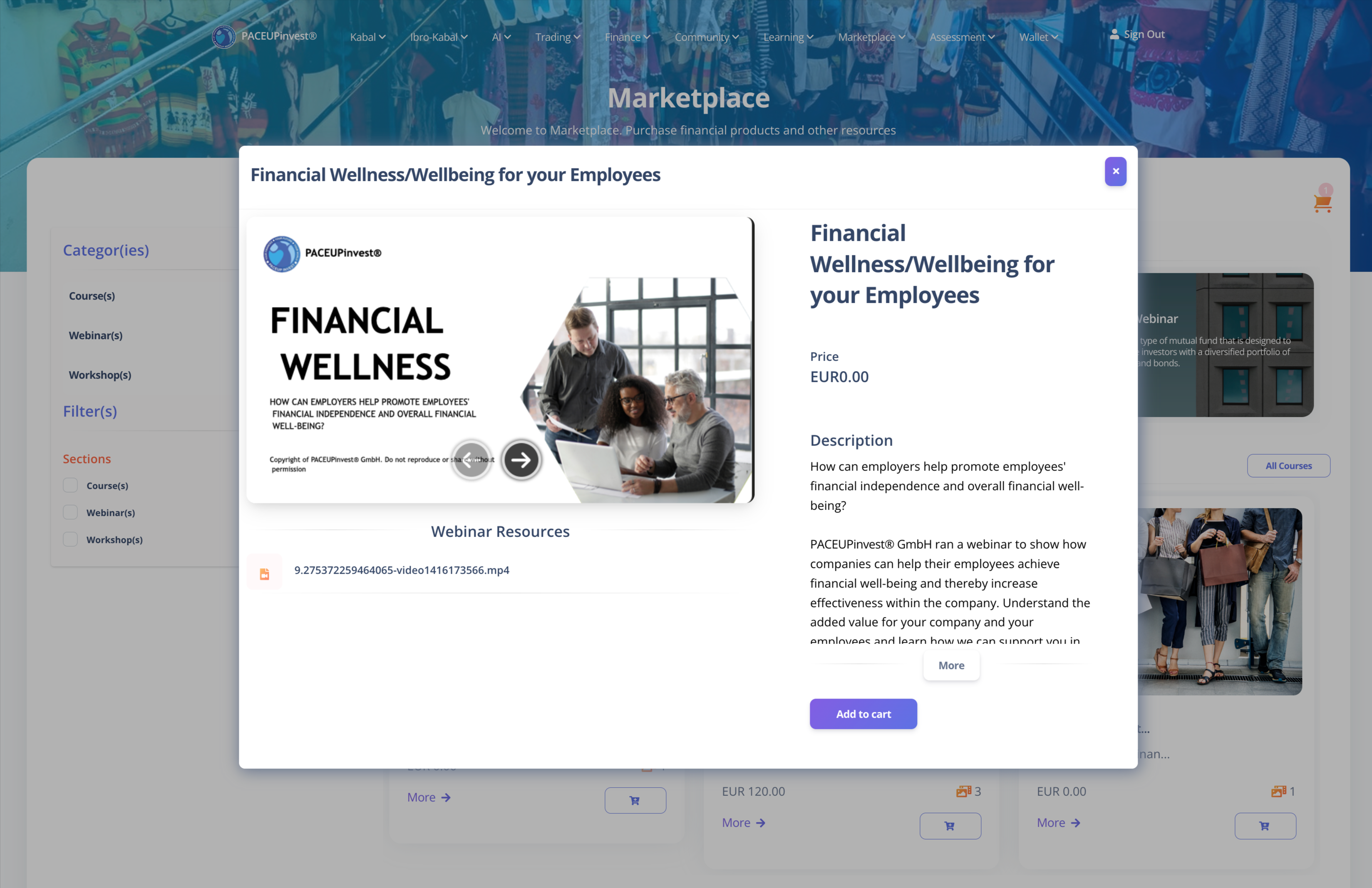

Self-Paced Financial Learning

Confused about where to start? Our Financial Learning Resources in the Marketplace will give you a head start, with personalised LMS, tailored to your learning, and completed at your own pace.

Learn more →

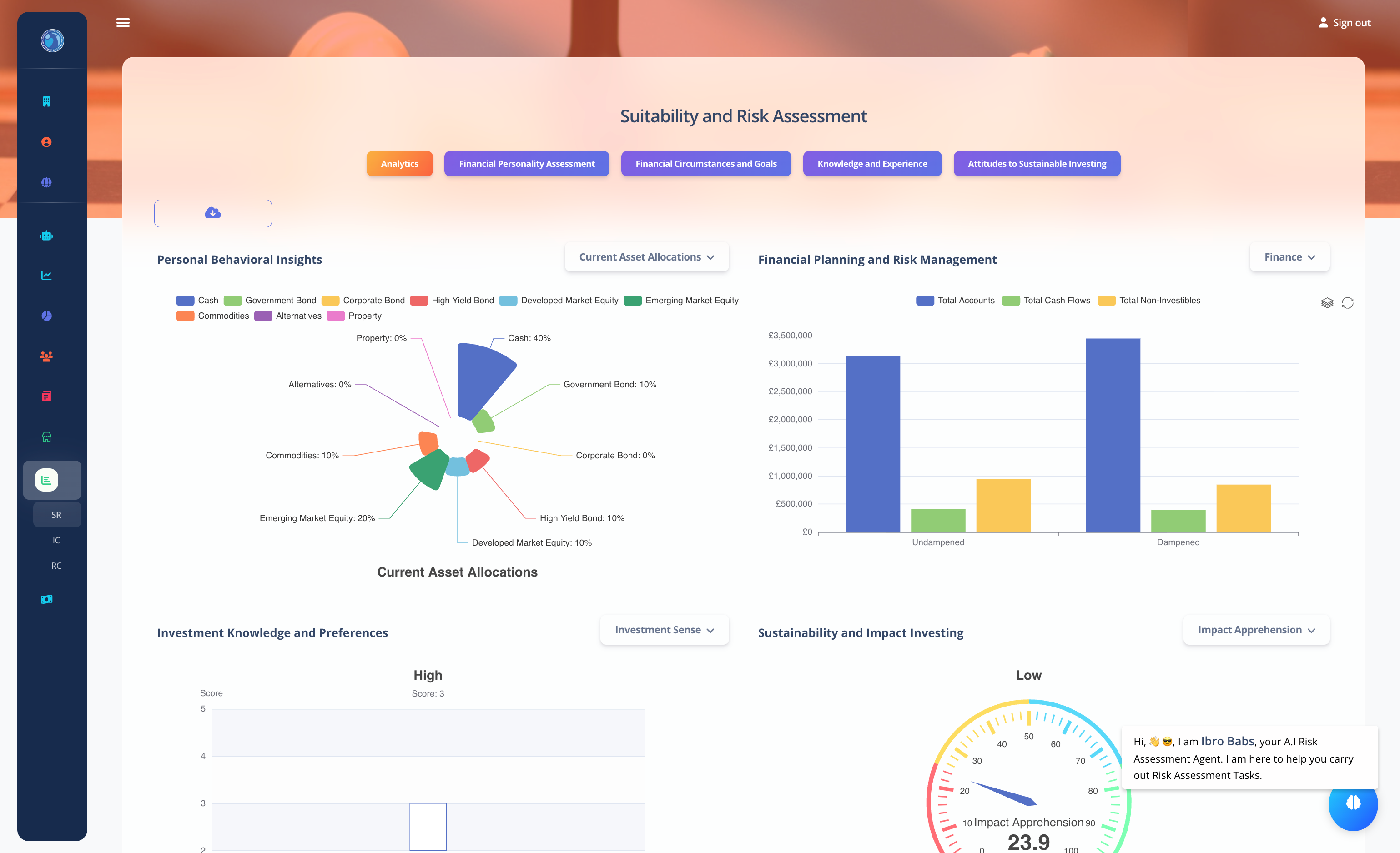

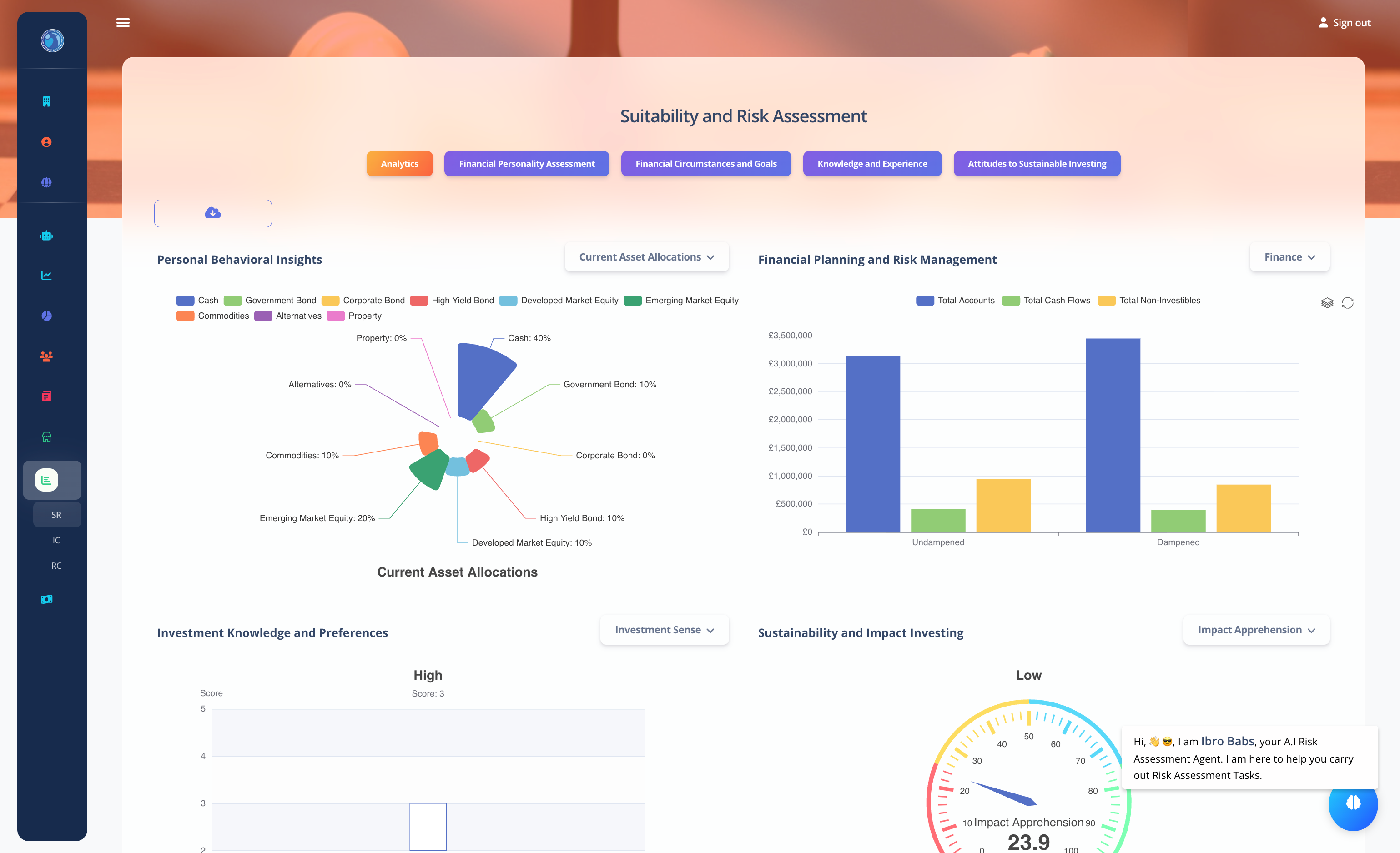

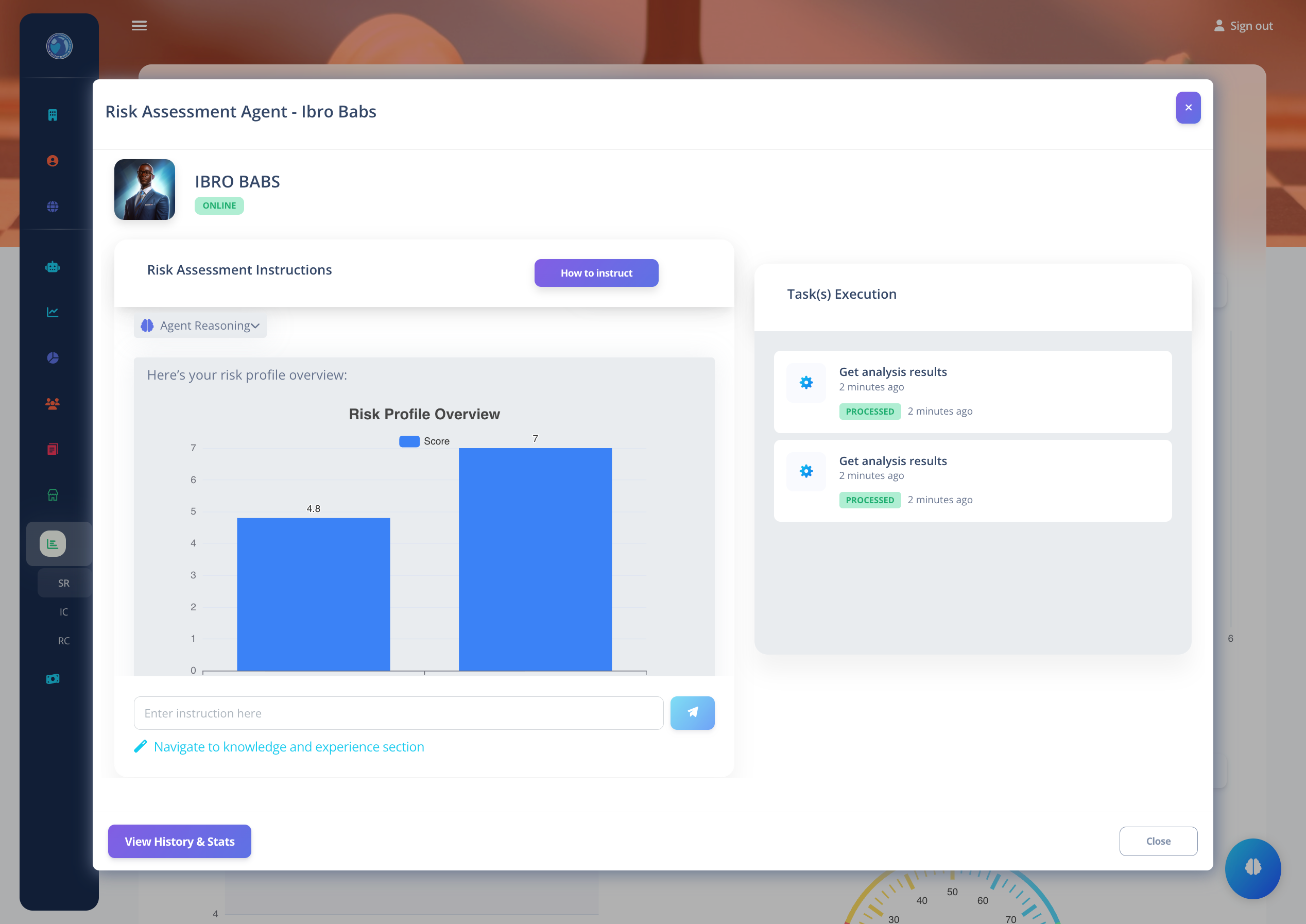

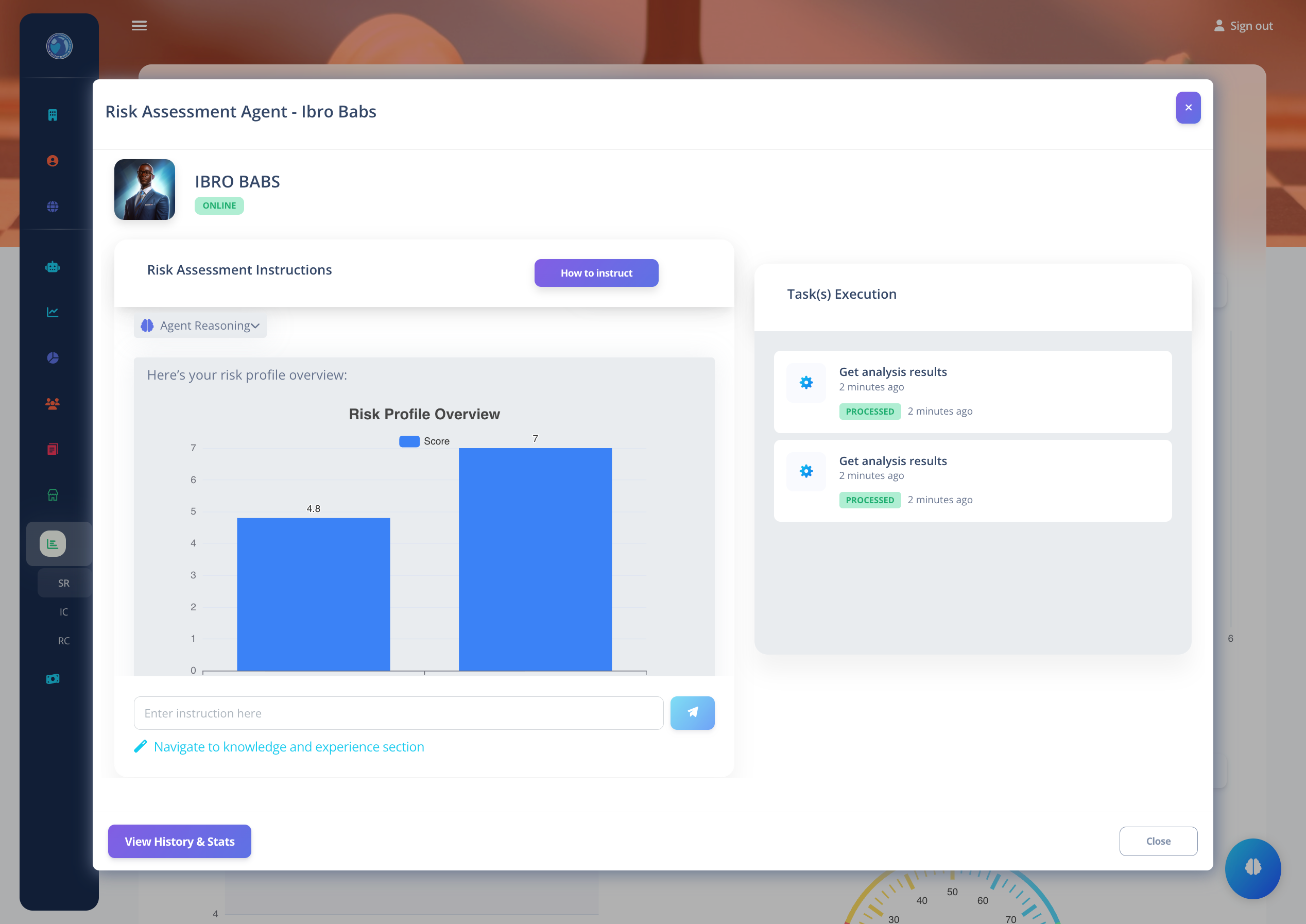

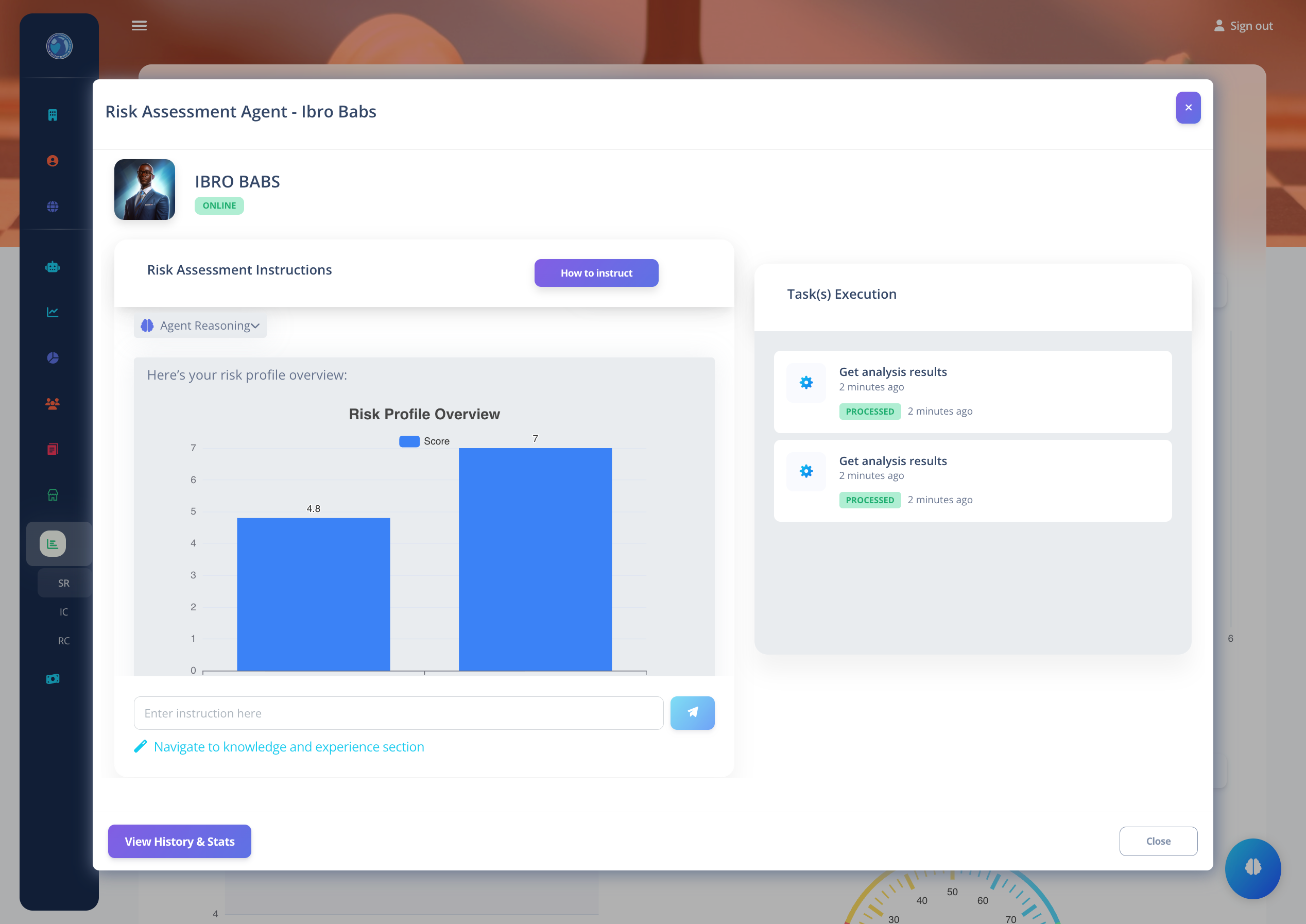

Behavioural Finance / Investment Risk Analysis

Determine your risk tolerance and ability. Have peace of mind with how it creates your Hyper-personalised Investment Portfolio in real time and use Generative Agentic AI to understand more about your finances.

Learn more →

PACEUPinvest's Unique Features

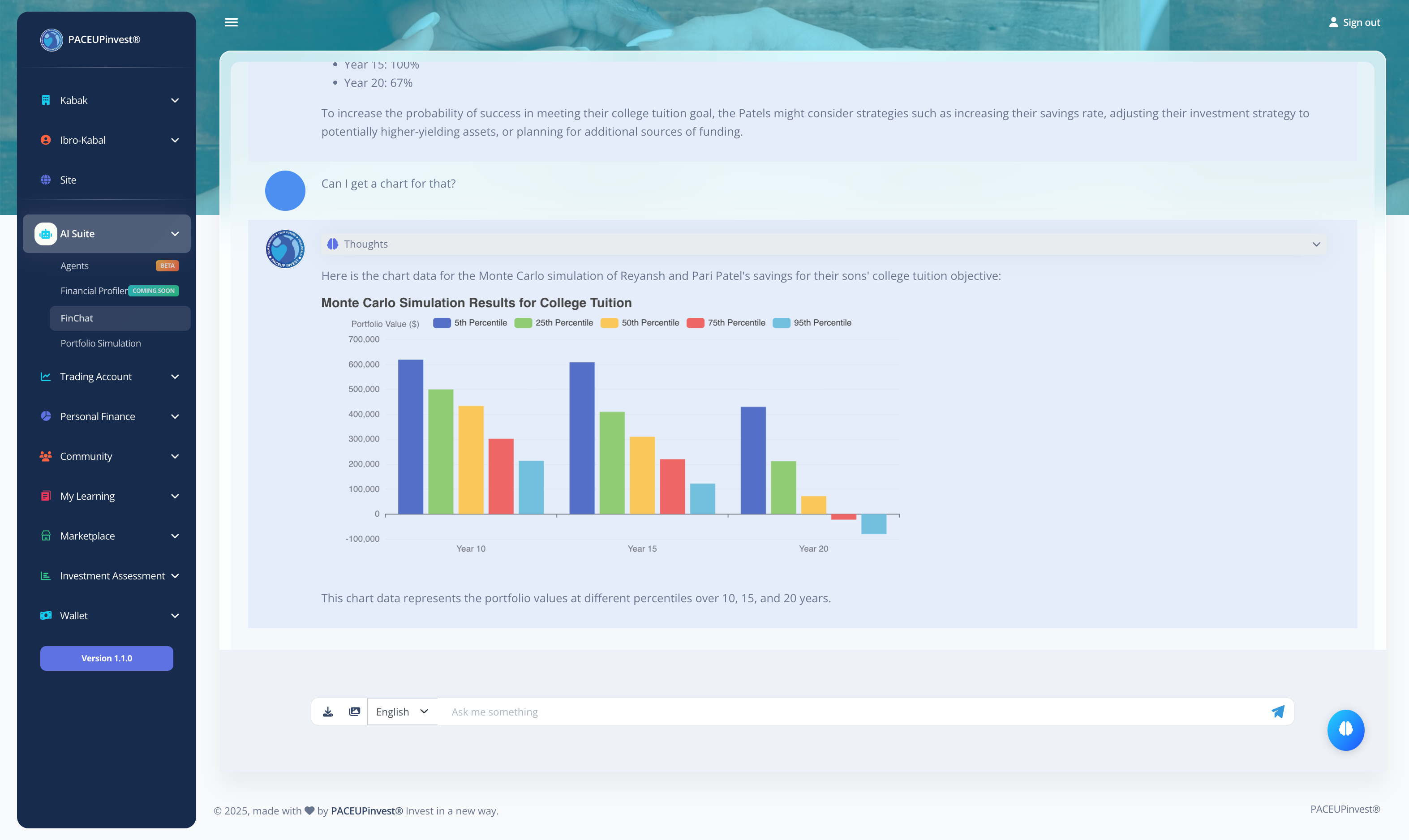

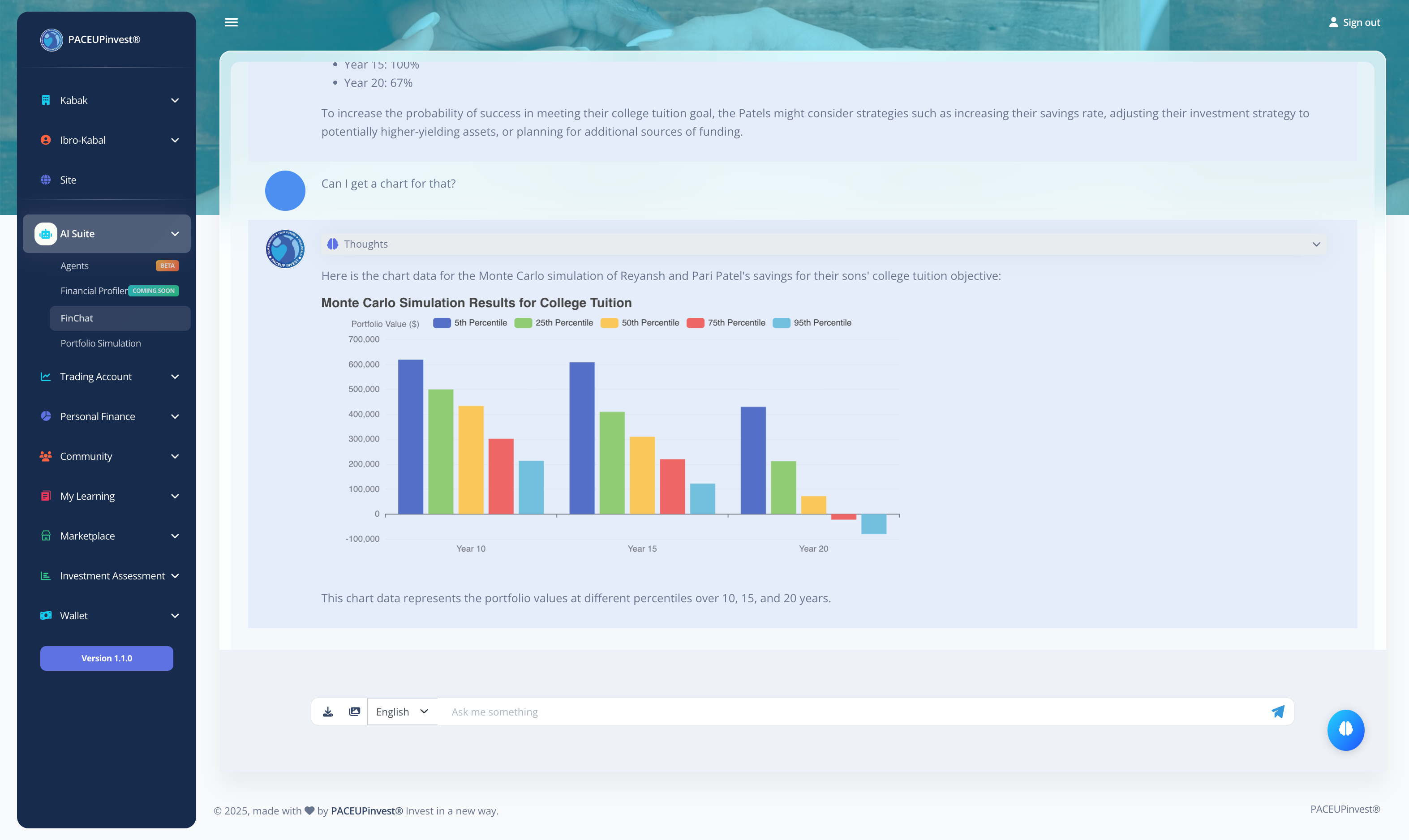

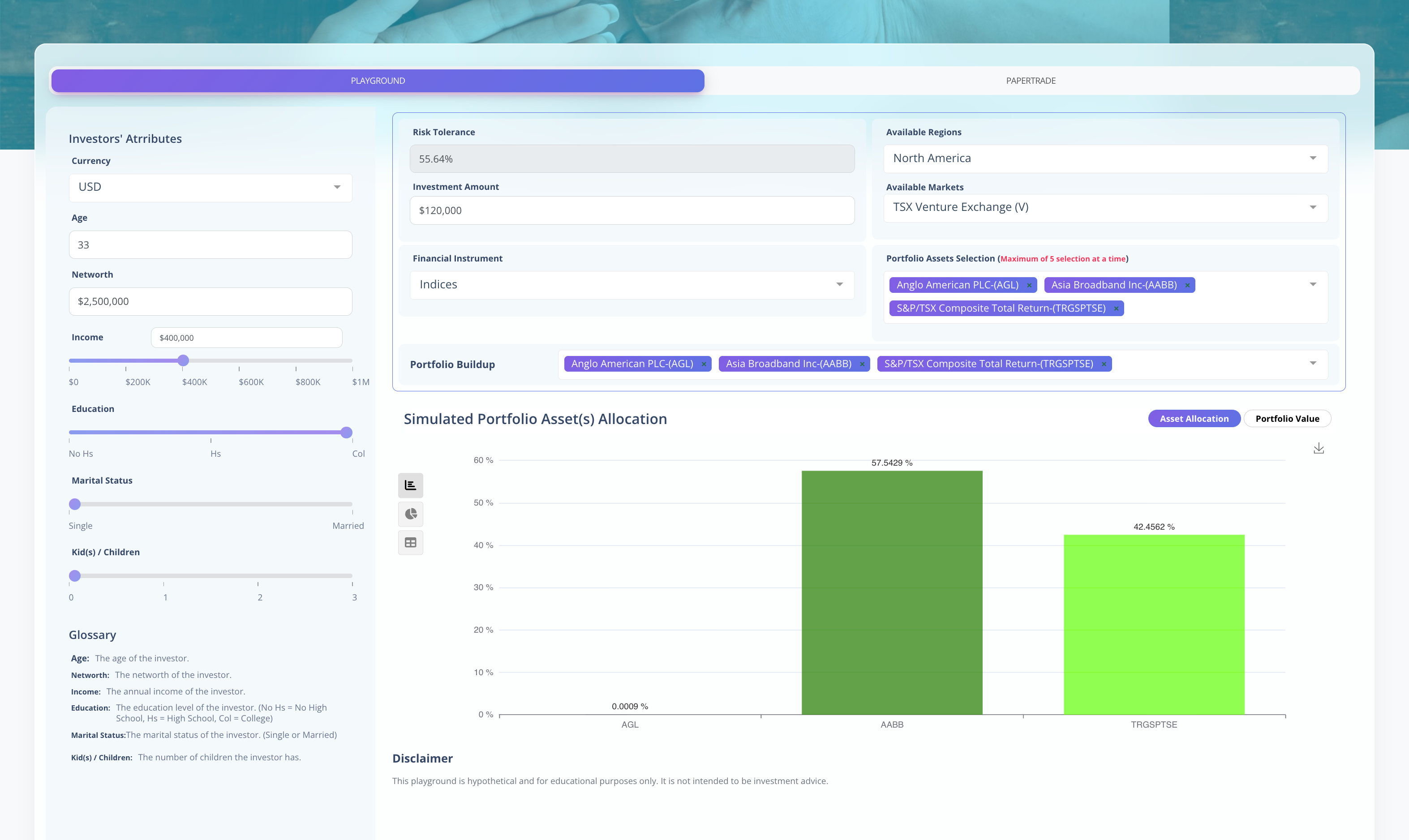

AI-Powered Portfolio Management

Let AI optimize your investments simulations with real-time analysis and automated rebalancing.

- Automated asset allocation based on your risk profile

- Real-time portfolio rebalancing to maintain targets

Intelligent Financial Insights

Get personalized recommendations powered by advanced AI analysis.

- Generate insights using natural language queries

- AI-driven market predictions and trend analysis

Personalized Learning Paths

Master financial concepts at your own pace with AI-curated content.

- Adaptive learning modules tailored to your level

- Interactive financial simulations and scenarios

Real-Time Risk Analysis

Monitor and manage investment risks with continuous AI monitoring.

- Instant risk alerts and notifications

- Comprehensive scenario analysis and stress testing

Choose Your Path

Empower Your Business with Financial Solutions

Your Personal Financial Journey

15000+

New visitors

every month.

88%

Impacted to

start investing.

€25M

Impact on

clients' assets.

95%

Improved healthy

financial habits.